CMS Middle East M&A Report 2024/25

Key contacts

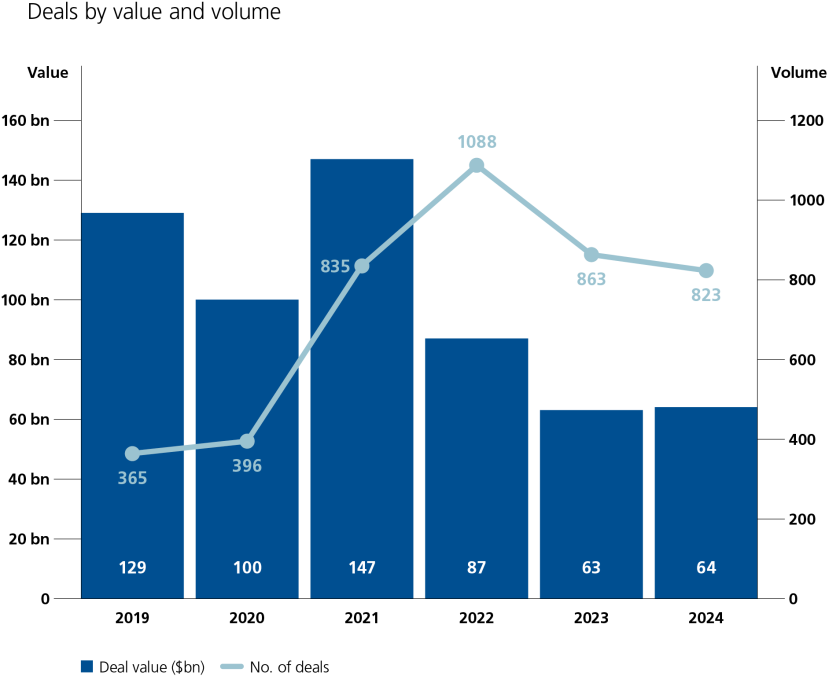

M&A activity time trend

Most countries in the region have become mature markets, attracting established investors and corporates due to the potential of their local markets and the services and products offered. There has been little change in the spread of M&A activity across sectors, reflecting the vision of most countries in the region to reduce their reliance on the Oil & Gas sector.

“This is the third consecutive year where deal value has remained under USD 100bn, and we’re waiting in anticipation for overall value to return to pre-COVID 19 levels. Despite this, what we are seeing is that countries across the region are becoming mature markets and are attracting established investors and corporates. Sovereign Wealth Funds have continued to drive activity and are influencing the investment landscape as they seek to diversify their portfolios to implement national strategies.”

Sector trends

“Deal activity in the Middle East has continued to focus on technology and fintech – in 2024, TMT deals accounted for 27.58% of all M&A activity across the region. Saudi Arabia and the UAE both are rapidly emerging as new tech hubs and their governments have set aside billions for investment into AI and fintech, so we expect to see this trend continue. We are also seeing increased activity around large-scale real estate transactions both within the UAE and regionally (such as the announcement of ADQ’s $35bn investment into Egypt); we anticipate this will generate additional deal flow and value in that sector through 2025 and beyond.”